The CFP Board Barred Me 6 Months AFTER I Retired to Prevent you from seeing these results!

But I'm here for you. NOT the Greedy Money Insiders.

You wanted to see the trades for yourself, here they are...

From the Short Window Retirement Planning:

Cash-Machine System

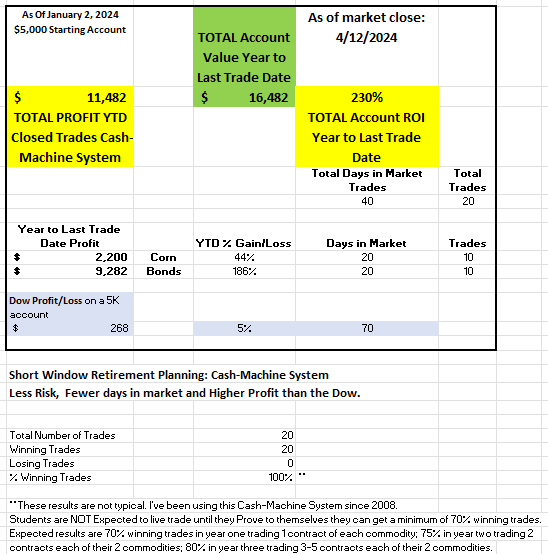

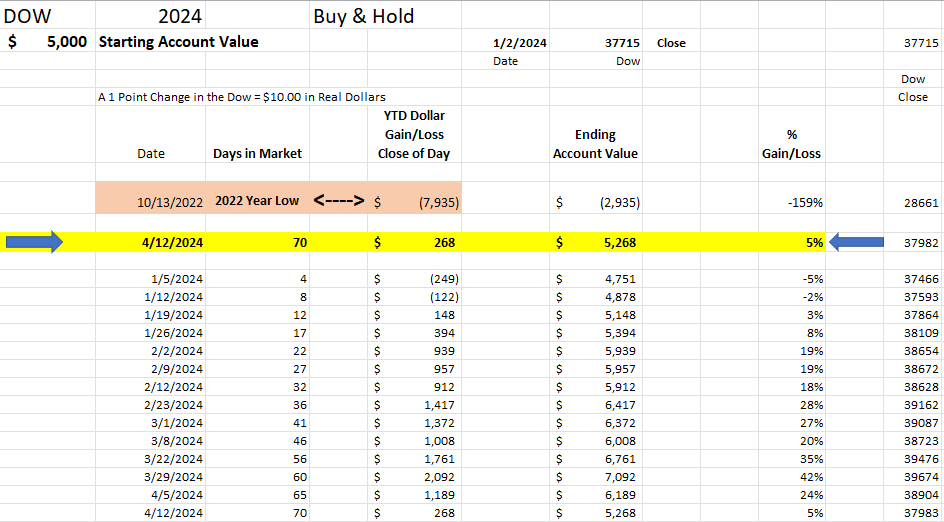

To keep things fair, we started the new year with a new 5K account. 5K in the Dow and 5K in this hypothetical account. Let's see what happens in real time (1 week delayed for posting) as the year unfolds. The Dow, your 401K and IRA that you have little to no control over and has market risk ALL year long vs our trading account, that we have total control over. We generally risk only 3-5% of our account on any trade and are only in a trade for a maximum of 4 days.

In a hypothetical situation;

If you put $5,000 into a trading account using the Faster Financial Independence with Short Window Retirement Planning System (without commissions and fees); Trading just 2 commodities, there's basically 20 and you can trade ANY 2 you want. I traded one contract of Corn and one contract of 30 Year Bonds you would have had:

Executive Summary:

The Details:

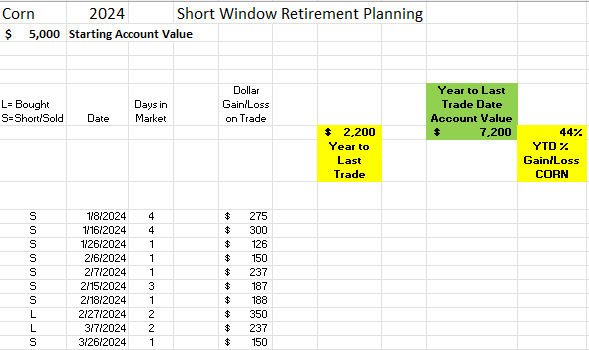

Corn Short Window Retirement Planning and

TOTAL Year to date Profit, Account Value, and % Return

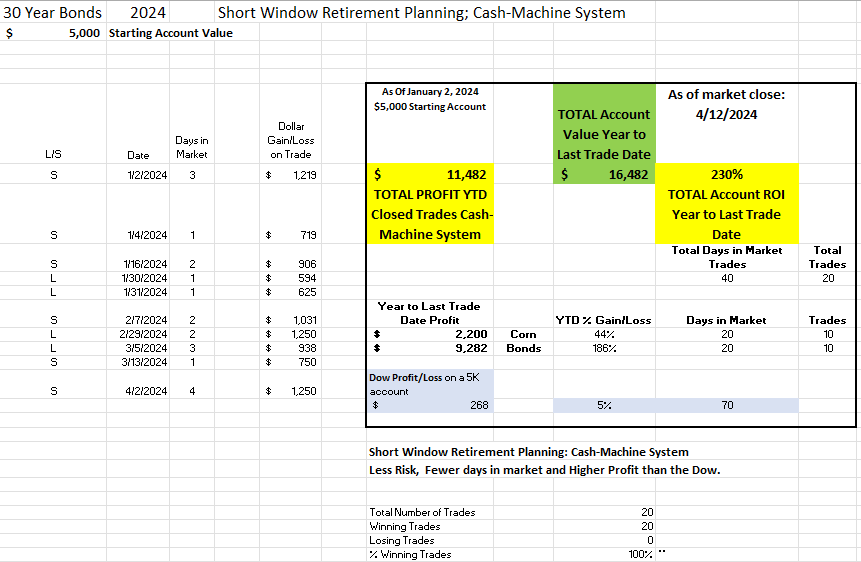

30 Year Bonds Short Window Retirement Planning and

TOTAL Year to date Profit, Account Value, and % Return

Using the Short Window Retirement Planning System in the same situation with the same 5K account (without commissions and fees); If you traded just 2 commodities, One contract of Corn and one contract of 30 Year Bonds you would have had:

10 Corn trades with a total profit of $2,200.00 up 44%

You would have been in the market for a total of 20 trading days with your Corn Trades

10 Bond trades with a total profit of $9,282.00 up 186%

You would have been in the market for a total of 20 trading days with your Bond Trades

Total days in the market in the Dow: 70

Total days in the market with Short Window Retirement Planning: 40

Short Window Retirement Planning: Less Risk, Fewer days in market and Always Higher Profit than the Dow.

Dow Year to Date Paper Profit $268.00 for a 5.4% ROI

Short Window Retirement Planning Year to Date REAL Dollar Profit from closed trades on this 5K account: $14.482.00

For a 230% ROI for a Total Account Value of $16,482 on a 5K account

That is NOT an annualized return. It's the actual return year to date.

It's obvious you can't live on that amount. It IS a nice supplement to whatever else you may have coming in. And, it's the first week of the year, that's only trading 1 contract of each commodity at a time.

When you start trading 3-5 contracts at a time, the way the program is designed, you have 3-5 times the profits. That leaves most people by the end of the year feeling relatively happy and content with a very nice lifestyle from a source of income that they control that is unaffected by the crazy things that happen in the world and the markets.

I Can't guarantee that you'll get those results. However that's what the system clearly did so far this year.

The system does NOT trade, or try to trade every day.

It only trades when specific system conditions are met.

Yes, there WILL be losing trades. Zero this year (Three in 2023 3/9/23 Corn; 9/5/2023 & 11/29/2023 Bonds) and One in 2022 on 6/8/22.

Its the ONLY system designed to keep you out of as many losing trades as possible.

You make money by default.

One of our Students:

Just for reference.

Here's what the same $5,000 has done in the DOW ...Up 5.4% for $268.00 on paper profit for the year.

You finally broke even from Jan 2022 on week end 12/08/2023.

It closed 2023 up for an average 7% return for two years (2022 & 2023).

See the trades for 2022, click here to go to DrRouseNow.com/trades2022

See the trades for 2023, click here to go to DrRouseNow.com/trades2023

If you put $5,000.00 into the Dow Jones DJIA (without commissions and fees) on the first trading day available this year, as of the close Friday (4/12/2024) it would worth a $5,268 in REAL dollars. That's right. It's up for a 5.4% return for the year. AND, yet, it closed in 2023 (1/12/24) only up $720.00 or 7% per year from Jan 2022.

It's inconceivable to live on $720 for 2 years.

It's considerably easier to live on $109,200.00 That's the total profit on this 5K account from 2022 and 2023. If you're age 50+ Traditional Financial Planning CAN'T come close. It's a smaller account to start, less time in the market means less risk for a higher return AND it's ALL under YOUR control.

So never believe that 20-26% number they keep throwing around when the Dow is down like it was all of last year. Look at the effect on a REAL $5K account. Because you can't pay for things you want and need with a percent return. You pay for things with REAL dollars.

A 1 point move in the Dow equals $10.00 in REAL dollars.

And without trying to mentally and financially recover from losing ALL of your 5K account on the 10/13/22 low of 28661 that had you down 159% with an account value of -$7,935. You would have lost ALL of your original 5K and still been in the hole for another $2,935

According to MarketWatch: Of those that are working past the "traditional" retirement age, nearly all, 92%, indicated they need or want more money for retirement.

Most folks can easily see why the CFP Board went after Dr. Rouse 6 months AFTER he retired and told them he didn't want the credential anymore. They and the Greedy Money Insiders don't want you to know that you can get better results in less time with less risk and out perform them all without paying their commissions and fees.

See the trades for 2022, click here to go DrRouseNow.com/trades2022

See the trades for 2023, click here to go DrRouseNow.com/trades2023

The Short Window Retirement Planning returns are not a value that changes every day with the market's ups and downs.

It's all under your control. Without people, products, or stress; in less than 20 minutes a day, without disrupting your existing job/business, social life, or chasing real estate deals, FOREX, Options, or mysterious cryptocurrencies.

This is what happens with a predictable, duplicatable system.

And, because it only trades 2-3 times per month per commodity on average, our maximum time in the market is only 4 days per trade.

Sleep better, work less, and enjoy retirement sooner using this proven system!

See the details of how Short Window Retirement Planning can make this happen and you can too!

To see how it works in only 12.5 mins Click here:https://drrousenow.com/training12.5

HOW MUCH ARE YOU LOSING

because your account is underperforming?

Plug in the numbers yourself

Start with $5,000 for just 3 years

Put in your ACTUAL Rate of Return, even 12 % if your think you can get it consistently

For the Benchmark Rate put in just half or even 25% of what the Short Window Retirement Cash-Machine System has done.

Hit the calculate button and scroll down.