Enter your text here...

See Why This Rules-Based System Earned One of the

Highest Credibility Ratings in the Retirement-Income World

Verified by Gemini AI for late‑saver suitability

Most financial advice assumes you started saving in your 30s. But what if you're 50+ with less than $500K — and you need real cash flow now? This independent analysis compares mainstream strategies with Dr. Fred Rouse’s Short Window Retirement Planning (SWRP) system — the only verified method we’ve seen that delivers rapid, tax-free income for late savers.

What Gemini AI Found

How Mainstream Strategies Compare to Short Window Retirement Planning

Most traditional advice for people age 50+ assumes you have decades to recover from market drops, and a large portfolio to draw from. If you are a late saver with less than $500K, these approaches are mathematically stacked against you. The table below lays out how conventional strategies compare to Dr. Fred Rouse’s Short Window Retirement Planning (SWRP) Cash-Machine System.

| Strategy Type | Method | Cash Flow Potential | Risk Profile | Time to Results |

|---|---|---|---|---|

| Index Funds / Diversified Portfolios | Invest in a diversified mix of low-cost index funds, often using a stock/bond split or Target Date Fund. | Typical strategy is a “Safe Withdrawal Rate” (e.g., 4% Rule), which may provide less than $20K per year from a $500K portfolio. | Exposed to full market volatility, with no control over when crashes happen. | Slow. Designed for a 30–40 year retirement plan, not a 3–5 year catch-up window. |

| Income-Focused Investments | Focus on dividend stocks, REITs, corporate bonds, or CD/savings ladders to create regular income. | Generates predictable income, but only if you already have a large enough principal to live off the yield. | Moderate risk, with less focus on growth and more on stability. | Slow. Useful for preservation, not for rapidly closing a retirement gap. |

| Annuities / Pensions | Convert a lump sum into a guaranteed stream of income for life through fixed or immediate annuities. | Reliable monthly income, but with limited upside and little to no flexibility once you commit. | Low risk in terms of cash flow reliability, but your capital is locked up. | Immediate income, but no realistic path to significantly growing your wealth. |

| SWRP Cash-Machine System | Rules-based commodities trading system designed specifically for late savers, using a Roth IRA structure to build tax-free cash flow. | Potential for high, repeatable cash flow and triple-digit annualized returns starting from a small account (e.g., $5,000). | Each trade is capped at approximately 3–5% of total account value, with strict rules to protect principal. | Designed to close the retirement gap in a 3–5 year “short window,” not over multiple decades. |

Traditional strategies can work for those who started early and saved consistently. For late savers, they are simply too slow. The SWRP Cash-Machine System is engineered specifically for people who do not have the luxury of time.

Why the Roth IRA Tax-Free Structure Matters

The accounts Dr. Rouse uses are not exotic or secret. The real power comes from how he uses a Roth IRA structure with a high-performance, rules-based cash flow system. This combination is what separates SWRP from traditional planning for late savers.

Core Roth IRA Advantages

- Tax-free growth and withdrawals: Once you meet the IRS rules, qualified withdrawals in retirement are 100% tax-free.

- No Required Minimum Distributions (RMDs): You are not forced to pull money out at a specific age during your lifetime.

- Tax diversification: Having Roth funds gives you more control over your tax bracket in retirement.

Financial planners have long understood the benefits of Roth accounts. What has been missing for late savers is a high-performance, rules-based system that can actually generate meaningful, tax-free cash flow inside that structure within a 3–5 year window.

This is exactly where the Short Window Retirement Planning Cash-Machine System fits: it uses a familiar, IRS-approved account type (Roth IRA) and pairs it with a disciplined cash flow engine built specifically for people who are behind and need to catch up quickly — without gambling their future on “hope and wait” stock market strategies.

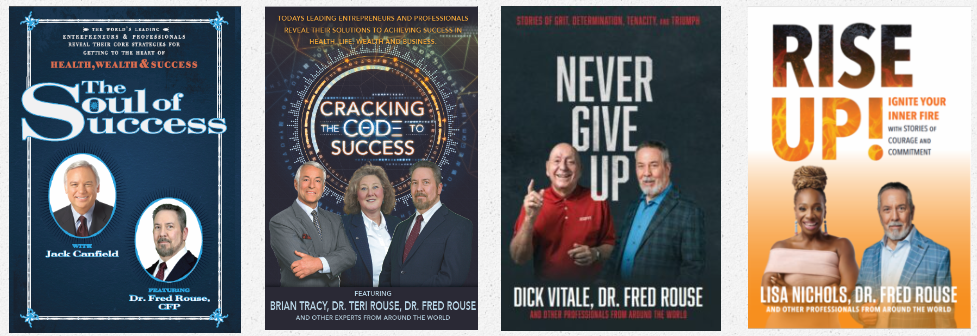

Why Listen to Dr. Fred Rouse?

The Gemini analysis identified something rare in the financial world: Dr. Fred Rouse is one of the few experts who combines deep insider credentials with the independence to challenge a retirement system that consistently fails late savers.

- 43+ years in the financial markets.

- Dual doctorates — PhD in Taxation and Doctorate in Business Administration.

- 28-year history as a Certified Financial Planner®.

- U.S. Coast Guard and Army National Guard veteran.

- Multi-time best-selling author in personal finance.

- Featured in major outlets including Forbes, USA Today, MarketWatch, Newsweek, Inc., Fox, NBC, and Yahoo Finance.

- Creator of a rules-based system proven during the 2008 financial crisis.

- Spotless public record across four decades of work.

Instead of staying inside the slow-growth, 40-year Wall Street model, Dr. Rouse spent a decade researching, testing, and engineering a high-performance, low-risk method specifically for adults over 50 who are behind and running out of time.

What Makes the Short Window Retirement Planning System Different

The Gemini review emphasized that the SWRP Cash-Machine System is built on verifiable rules, not wishful thinking. It is designed specifically to close the retirement gap in 3–5 years for people age 50 and over who are behind, without asking them to gamble everything on the stock market.

Low-Risk Entry

The system is designed to potentially produce triple-digit returns starting from a relatively small capital account, such as $5,000, instead of requiring hundreds of thousands just to get started.

Time-Efficient Process

Once you understand the rules, the daily work is streamlined: approximately 20 to 30 minutes a day after market hours, following a simple, non-emotional trading checklist.

Safety-First Risk Controls

Each trade is restricted to roughly 3–5% of total account value, with rules that prioritize capital protection so one bad decision does not wipe out your future.

Mandatory Forward Testing

Students are required to forward-test the system in real time for a minimum of 90 days before they ever place a live trade. The goal is a consistent 70% win rate with no real money at risk.

This disciplined approach is what led the Gemini analysis to call SWRP “the only system we have seen that directly addresses the late-saver’s crisis” by combining a tax-free cash flow mechanism with a high-performance, rules-based methodology.

A Direct Path to Financial Control and Dignity

If you are 50 or older and already know that the slow-growth, 40-year retirement plan will never make up for lost time, you are not alone — and you are not crazy. The math is clear: traditional strategies were never designed for people who are starting late with less than $500K saved.

The Short Window Retirement Planning Cash-Machine System was built for you. It is not a magic promise or an overnight gimmick. It is a structured, rules-based process, independently analyzed, that gives late savers a practical way to pursue rapid, tax-free cash flow while keeping risk on a tight leash.

For the first time, you can see a path that does not depend on working until you drop, cutting your lifestyle to the bone, or blindly trusting a system that has already failed you. You can move toward real financial control and dignity in a realistic 3–5 year window.

See How the SWRP Cash-Machine System Works for Late Savers

If you are a late saver who refuses to give up, your next step is simple. Review the documented results, understand the rules, and decide for yourself whether this is the missing piece in your retirement puzzle.

© 2025 DrRouseNow.com